For many investors, there is a great deal of mystery surrounding alternative investments. They’re described as exotic, for the ultra-wealthy or too volatile.

The reality is, alternative investments cover a broad range of vehicles with the goal of helping to enhance returns, add diversification, and provide an overall portfolio with some downside protection for suitable investors with the relevant knowledge and experience in these products. So it’s worth taking a look at some of the most common misconceptions.

Alternatives are Nothing New

One lingering misunderstanding about alternatives is that they are new, exotic investment vehicles without long-term track records. This is a common misconception when, in fact, alternative investments have existed for decades. For example, hedge funds have been around since the 1940s, and began experiencing rapid growth starting in the 1980s.

Of course, alternatives include much more than hedge funds. Alternatives encompass a wide variety of investments such as private equity, managed futures, real estate and exchange funds.

The Daredevils of Finance

Another major misconception is that alternatives are excessively risky. While it’s certainly true that they have unique and sometimes considerable risks which investors should understand prior to purchasing, alternatives are actually designed to mitigate risk and manage volatility over time when used as a component of a diversified portfolio.

Alternative asset classes often employ unique strategies and exposures, like leverage, shorting and derivatives. While these nontraditional investment options and strategies may be complex and involve higher risk, by their very nature they are designed to provide better risk-adjusted performance than traditional long-only products.

The graph below provides a look at risk and return over the last 25 years. As you can see, having an allocation to alternatives both enhanced returns and reduced risk for investors.

Past performance is not indicative of future results. Please see Important Disclosures at the end of this article.

Fears of Increased Volatility

A third misconception is that alternative investments will actually magnify the overall volatility of a portfolio. But again, a closer look reveals the whole story. Alternatives possess historically low to moderate correlation of returns to traditional investments. Diversifying a traditional investment portfolio with the appropriate alternatives may help reduce overall volatility.

During times of increased volatility for stocks and bonds, the low correlation between those two asset classes and alternative investments comes even more sharply into focus, meaning that a strategy of heterogeneous diversification becomes more attractive.

The Illiquidity Issue

Often investors may hold the belief that all alternative investments are illiquid—which adds to the perception of alternatives being risky. While some strategies do tend to have longer investment horizons and therefore lock up periods, some equity managers do have much shorter lock ups. However, while alternatives have varying levels of liquidity, this is usually balanced by improved returns. This is often called an ‘illiquidity premium’.

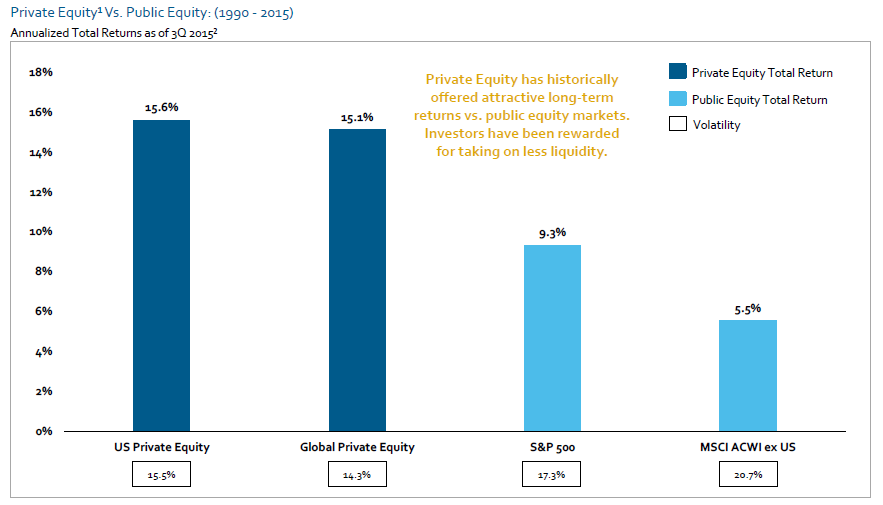

The chart below takes a look at a comparison of the returns between private and public equity over a twenty-five year period. Private equity has historically offered attractive long-term returns vs public equity with the understanding that investors have been rewarded for taking on less liquidity.

Alternatives Are Only for Institutional Investors

A final misconception about alternatives is that they are only accessible to institutional investors. While that may have been true years ago, today these investments are available to retail investors that meet required suitability and knowledge or experience criteria.

Morgan Stanley’s goal is to provide clients that meet suitability requirements with access to some of the industry’s best global alternatives managers and investment opportunities.

Morgan Stanley has a seasoned team with access to global research and insight to help you choose appropriate investments to meet your needs. To start the conversation about alternative investments, speak to your Morgan Stanley financial adviser.

Figure 2 - Private equity index data sourced from Thomson ONE’s Cambridge Associates benchmarking database and is represented by Buyout, Distressed, Growth Equity, Mezzanine, Private Equity Energy, Upstream Energy & Royalties and Venture Capital. US and Global Private Equity data subject to 5-month lag; therefore, all asset classes are depicted as of 3Q 2015 for consistency. Private equity returns are net to limited partners.

The sole purpose of this material is to inform, and it in no way is intended to be an offer or solicitation to purchase or sell any security, other investment or service, or to attract any funds or deposits. Investments mentioned may not be suitable for all clients. Before making any investment, each investor should carefully consider the risks associated with the investment, as discussed in the applicable offering memorandum, and make a determination based upon their own particular circumstances, that the investment is consistent with their investment objectives and risk tolerance.

Alternative Investments typically have higher fees than traditional investments.

Indices are unmanaged and investors cannot directly invest in them. Index results are shown for illustrative purposes and do not represent the performance of a specific investment.

Alternative investments may involve complex tax structures, tax inefficient investing, and delays in distributing important tax information.

© 2017 Morgan Stanley. All rights reserved.

This disclaimer is specific to this article and needs to be added in addition to the standard disclaimer which already appears at the bottom of the article published on Yext.